Highlights

Chaos Continues With Ohio Teachers’ Pension Fund as Second Advisor Quits

Source: https://www.news5cleveland.com/

A second consulting group has withdrawn from Ohio’s troubled retired teachers’ pension fund, adding to its ongoing turmoil. Anxiety is pervasive at the State Teachers Retirement System (STRS), which is plagued by frequent disputes, two board resignations, and accusations of corruption and financial mismanagement.

Key Highlight:

- The controversy at STRS revolves around investment strategy: reformers advocate for switching to index funds, which track the market passively at lower cost, while supporters of the status quo prefer actively managed funds that aim to outperform the market despite higher costs. Recent board elections have shifted majority control to reform-minded members. The ongoing debate has been extensively covered, including recent reports on corruption allegations.

- McLagan, a data and analytics firm, has been advising STRS on compensation matters for over two decades. Recently, they informed STRS that they are unable to assist with a request related to the July 19, 2024 board meeting, despite appreciating the opportunity to continue their advisory services under a new Statement of Work (SOW). McLagan emphasized their longstanding partnership with STRS and expressed willingness to address any questions regarding their previous work. The decision comes amidst a context where the STRS board recently blocked staff from receiving performance-based incentives (PBIs), commonly understood as bonuses.

- McLagan, a consulting firm, has notified STRS Ohio that they cannot currently provide requested compensation consulting services. Despite this, STRS plans to proceed with discussions on investment staff compensation at their upcoming board meeting. Aon, the parent company of McLagan, had also withdrawn its services from STRS in May, raising concerns about governance within the pension system. Brian Grinnell, former Chief Actuary at STRS, expressed deep concern over these developments, warning that eliminating performance-based incentives could lead to significant income reductions for staff, potentially causing talented individuals to leave. He emphasized the critical role of staff in generating returns for teachers’ pensions.

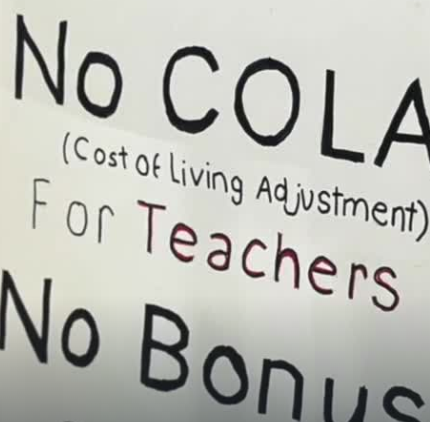

- Robin Rayfield, executive director of the Ohio Retirement for Teachers Association (ORTA), advocates for reducing the investment staff at STRS to improve returns through indexed investing. He and other retirees support board members focused on providing a full cost-of-living adjustment (COLA) for retired teachers, highlighting frustration over restricted COLA compared to staff bonuses, such as the $10 million approved last year. Retired teacher Sharon Parker questions the fairness of these bonuses when retirees struggle to receive adequate cost-of-living adjustments.

- The Ohio State Teachers Retirement System (STRS) suspended cost-of-living adjustments (COLAs) for over 150,000 retired teachers from 2017 to 2022. Changes in retirement qualification criteria have occurred, shifting from 30 years to 35 years in 2012, then to 34 years in 2023. The STRS headquarters in downtown Columbus features amenities like a fitness center and outdoor balcony, but controversial perks like a closed childcare center have sparked debate.

- Teachers, such as Terry Caskey from Parma schools, criticize large staff salaries and $10 million in bonuses amid ongoing financial constraints. Former STRS Chief Actuary Brian Grinnell argues that while $10 million is minimal compared to needed billions for COLA restoration, sustainability remains a challenge without significant external funding. Case Western Reserve’s Eric Chaffee acknowledges both perspectives, noting concerns over optics versus long-term STRS stability amidst ongoing scrutiny.

Image Source: https://www.news5cleveland.com/